|

|

|

|||

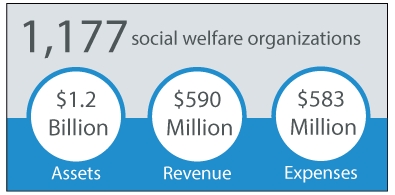

Social welfare, 501(c)(4) nonprofit organizations, also known as civic leagues, are created to further the common good and general welfare of the community, by bringing about civic betterment and social improvements. Similar to a 501(c)(3) organization, the income of social welfare organizations is generally tax-exempt as long as they comply with the IRS requirements. Different from 501(c)(3) organizations however, contributions made to social welfare organizations are mostly not tax-deductible by donors, although some exceptions apply. Another important difference is that while 501(c)(3) organizations engage in limited lobbying activities, 501(c)(4) organizations are allowed to have lobbying as their primary activity. The political engagement of social welfare organizations however should still be treated with care. |

||||

|

Social Welfare Organizations by Type (NTEE) FusionCharts.

Most of the social welfare organizations in Arizona are dedicated to the improvement of the community. In this category we find the City of Glendale municipal property and all community associations. Arizona Dental Insurance Service, which belongs to the Health Care subcategory, was the largest social welfare organization in Arizona in 2012 with $154 million in revenue. Their purposes is to make dental care accessible by coordinating participating dentists and individuals. Several 501(c)(3) organizations create a social welfare partner 501(c)(4) - or viceversa, to further their mission Such is the case of Food for the Hungry. To view more 501(c)(4) organizations and customize a report by county, click here and filter by Internal Revenue Code. |

Top 20 Social Welfare Organizations Revenue FusionCharts.

|

|||

|

|