|

|

|

||||||||||||

Private foundations derive most of their funding from a single source which can be a family, an individual, or a corporation. All private foundations are required to file a form 990PF. The vast majority of the private foundations operate by making grants to other nonprofit organizations which partner with them to achieve a common charitable mission. These are known as grantmaking foundations or non-operating foundations. |

|||||||||||||

|

Some private foundation also execute direct charitable activities. They are known as private operating foundations. Private operating foundations have higher philanthropic support from the public than do grantmaking foundations. Also, private operating foundations are not subject to the excise tax on failure to distribute income that grantmaking foundations are subject to. |

|

||||||||||||

Private Foundations vs. Grantmakers Most private foundations are by definition grantmakers since a great part of their charitable activities consist on giving grants to other nonprofits that pursue their same mission or interests. However, not all grantmakers are private foundations. A great amount of grantmakers are public charities. Private operating foundations make direct charitable contributions which are not in the form of grants. In this part of the report, whenever we refer to charitable contributions of private foundations we include both the grants paid by all foundations, plus the charitable expenses of private operating foundations. To understand more about grantmakers, and to analyze their grants paid to other charities refer to the section Grantmakers. |

|||||||||||||

Top Private Foundations Community Finance Corporation is the largest private foundation in Arizona by assets size, with $947 milions in assets in 2012. However, its major operation is through loan programs rather than grantmaking. Virginia G. Piper Trust is the second largest private foundation in Arizona with $533 million in assets and it is also a major grantmaker, with about $15 million in contributions paid to other nonprofits in 2012. Nina Mason Pulliam Charitable Trust is based in Indiana, the reason why it is not included in the top list. However it contributed over $6.8 million in grants to Arizona nonprofits in 2012, almost half of its total grants paid that year. |

|||||||||||||

|

Top Arizona Private Foundations by Assets

(M=$Millions) Source: NCCS Circa 2012 and IRS 2014 FusionCharts.

|

Top Arizona Private Foundations by Charitable Contributions *(M=$Millions)

Source: NCCS Circa 2012 and IRS 2014 FusionCharts.

*includes charitable expenses for private operating foundations |

||||||||||||

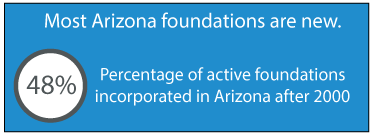

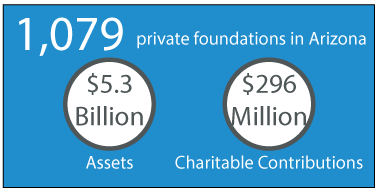

Size and Age of Private Foundations Private foundations in Arizona hold a total of $5.3 billion in assets. The majority of foundations, 59 percent or 637 foundations, are small - each holding less than $500,000 in assets. The 59 largest foundations, those that hold over $10 million in assets, comprise about four percent of the total number of private foundations; large foundations combined provide 48 percent of the total charitable contributions in the state of Arizona. As it can be seen on the chart at the bottom, most Arizona foundations are new. A total of 48 percent of the active foundations, 521, were incorporated after year 2000. |

|||||||||||||

|

Number of Arizona Private Foundations by Asset Size FusionCharts.

Total Private Foundations: 1,079

|

Charitable Contributions by Arizona Foundation Size FusionCharts.

Total Charitable Contributions: $296 Million Number of Arizona Foundations by Year of Incorporation FusionCharts.

|

||||||||||||

|

|