|

| |||||||||

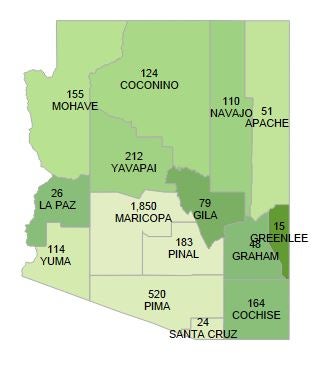

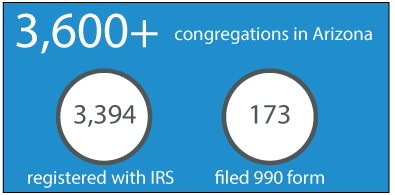

Although religious congregations are required to meet the legal requirements of Internal Revenue Code 501(c)(3), they are not required to obtain official recognition from the IRS. Most congregations, however, choose to become officially IRS-recognized as a public charity. As of 2014, there were an estimated 3,675 congregations in Arizona, of which approximately 3,394 were IRS-recognized. The chart below illustrates the location of congregations by Arizona county. The shades on the counties indicate the number of congregations per capita. Number of congregations in Arizona counties and number of congregations per capita Congregations per 1,000 people

|

Congregations are also not required to file an annual 990 form, and most of them do not. In 2012 only five percent of congregations (approximately173) filed either a 990 or a 990EZ. Congregations that Filed a 990 Form in Arizona

Source: NCCS Circa 2012 and IRS 2014

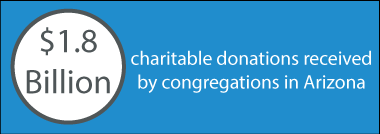

It is estimated that congregations received approximately $1.8 billion in donations in 2012, an estimate based on the Arizona Giving and Volunteering study, which found that 42 percent of households gave to religious purposes in 2008 at an average of $1,772 per household.

|

|

|