Samuel P. Goddard Papers

12th Governor of Arizona

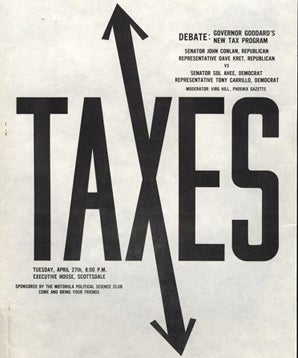

Tax Programs

On February 23, 1965, Governor Goddard proposed a Fair Share Tax Program which was designed to shift a significant amount of property owners’ tax burden to a broader portion of the taxpaying public. The program was intended to reduce the taxpaying load on homeowners as it increased funding for education. It demanded an increase in the state’s share in the cost of education with a corresponding decrease in school district tax rates. State aid per student was to be raised from $170 to $250, but only after the school district’s property taxes had been reduced. In order to increase the state’s share of the cost of education while lowering property taxes, Goddard’s program sought to generate revenue through a variety of sources, which Goddard hoped would result in a more equitable tax program. Goddard’s Fair Share Program called for a five cent increase on the tobacco tax, and the raising of the sales and education taxes on restaurants, night clubs, utilities, and mining from one and one-half percent to a three percent charge. It also recommended streamlining and modernizing the Arizona Tax Income Code, the creation of a State Building Authority to allow future taxpayers to help pay for needed state facilities, and redistribution of sales tax revenues to counties on the basis of population. 1 Despite lowering property taxes and increasing funding for schools, Goddard’s Fair Share Tax Program was not particularly popular and may have been a factor leading to his re-election defeat. Newspaper articles and letters to the Governor at the time focused solely on the increase in sales taxes, while giving little or no attention to the decrease in property taxes and the increased funding for schools. As a result, Goddard and his representatives were consistently under attack for their “tax and spend” policies and were forced to constantly defend and explain the subtleties and benefits of the program. The Goddard administration’s failure to cut through their opponent’s misinformation and get their message across clearly continually hampered the governor’s effectiveness and ability to make the reforms he wanted and needed to make. |

|

||

| 1 Governor's Office Press Release, February 23, 1965. Office of the Governor: S.P. Goddard 1965-1966, Box 56, File "Press Releases January - March 1965." RG 1 SG 19. Arizona State Library, Archives, and Public Records. | |||

Previous Page |

Next Page |